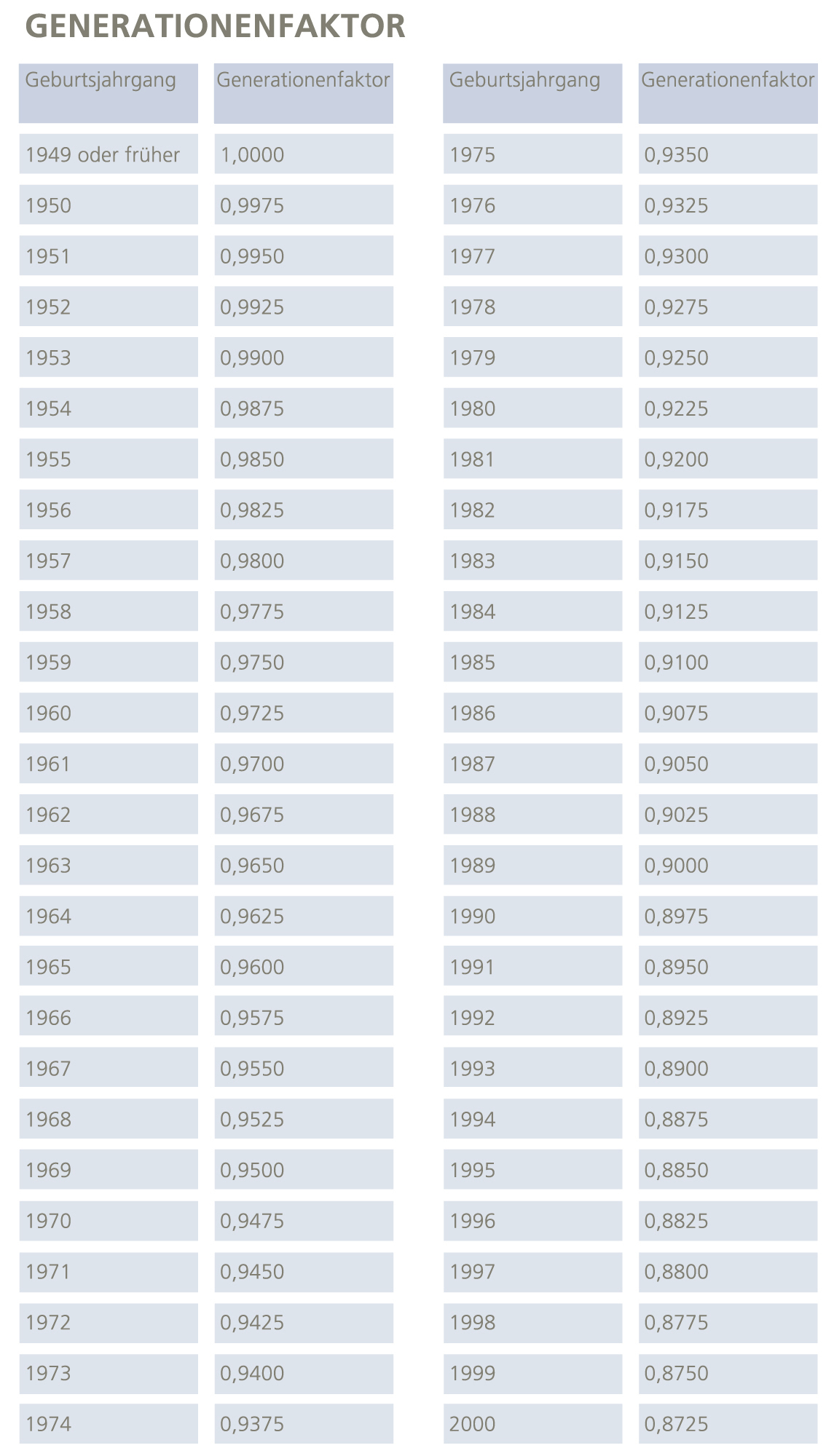

Zur Bewältigung des aus der Längerlebigkeit der Mitglieder resultierenden Finanzbedarfes wurde im Berichtsjahr 2008 die Einführung eines Generationenfaktors beschlossen. Dieser wird ab dem 01.01.2009 für alle Jahrgänge ab 1950 auf die bestehende Gesamtrentenanwartschaft angewandt. Er beträgt 100% für den Geburtsjahrgang 1949 und verringert sich in jedem darauffolgenden Jahrgang um 0,25%-Punkte. Die demografische Entwicklung hat hiermit Eingang in die Rentenformel gefunden und entlastet die Passivseite der Bilanz. Der Generationenfaktor führt damit zu einer, vom Geburtsjahrgang abhängigen, moderaten Absenkung der Anwartschaft. Eine monatliche Rentenhöhe von 2.000,00 EUR verringert sich exemplarisch wie folgt:

Der Einführung des Generationenfaktors liegt die Überlegung zugrunde, den Finanzbedarf, der aus der Längerlebigkeit der Mitglieder resultiert, nicht lediglich aus den Erträgen der kommenden Jahre zu finanzieren. Ein solches Vorgehen würde zur Benachteiligung älterer Mitglieder führen. Sie müssten den Finanzierungsbedarf aus den Berufsständischen Richttafeln 1997 und aus den Berufsständischen Richttafeln 2006 mittragen, obwohl die biometrische Belastung des Versorgungwerkes aus der Längerlebigkeit, insbesondere der jüngeren Mitglieder, resultiert. Es ist daher erforderlich, ältere Mitglieder zu schützen und einen Teil des finanziellen Aufwandes zur Finanzierung der Längerlebigkeit über den Demografiefaktor jahrgangsbezogen zu verteilen. Das bedingt für jüngere und zukünftige Mitglieder moderate Anpassungen in der Anwartschaft.